Blog > Why More Homeowners Are Giving Up Low Mortgage Rates

Why More Homeowners Are Giving Up Low Mortgage Rates

by Sherie Berry

For the last few years, one question keeps coming up again and again:

Why would anyone give up a low mortgage rate?

With so much attention on interest rates, it’s easy to assume homeowners are frozen in place. But the data tells a different story. More people are moving—and taking on higher mortgage rates—than many realize.

Let’s break down what’s actually happening and why mortgage rates aren’t stopping life from moving forward.

Life Doesn’t Pause for Mortgage Rates

While interest rates matter, they aren’t the only factor driving housing decisions. Homeowners continue to move because of real-life changes, including:

-

Job relocations

-

Growing families and the need for more space

-

Downsizing after children move out

-

Divorce or lifestyle changes

-

Wanting to be closer to family

For many homeowners, staying put simply doesn’t work anymore—even if their current rate is low.

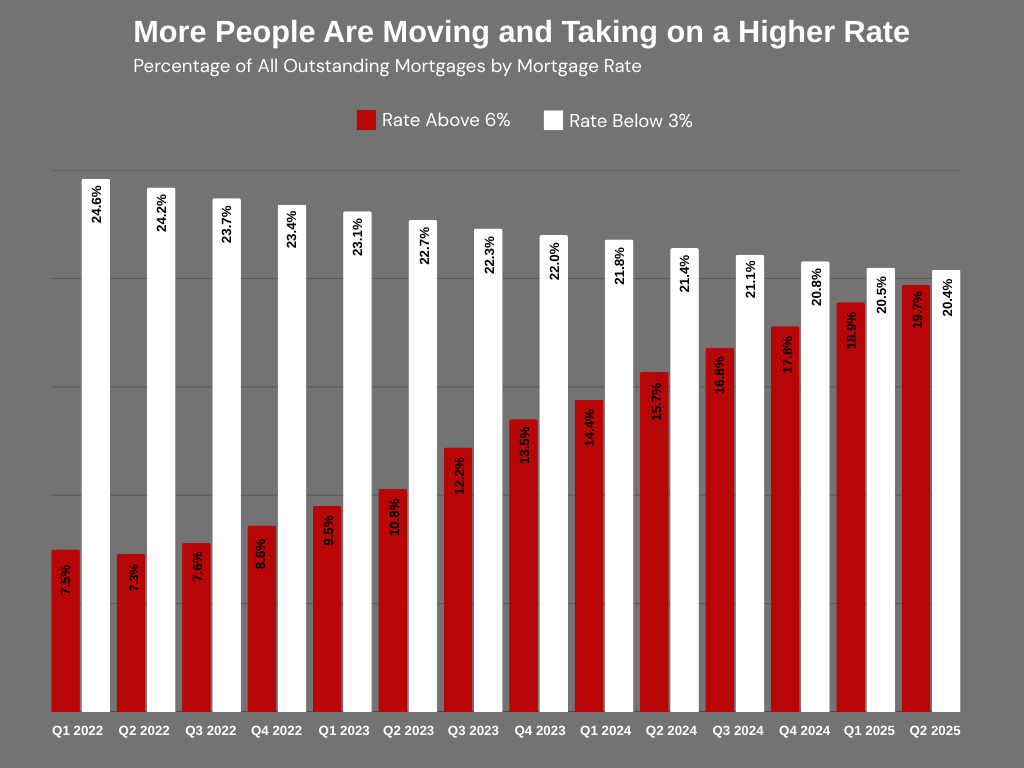

More Homeowners Are Moving Despite Higher Rates

Recent data shows a steady increase in homeowners who are selling their homes and taking on higher mortgage rates in order to make a move.

Key takeaway:

The number of homeowners moving and accepting higher mortgage rates has been climbing, showing that decisions are being driven by necessity—not just financing.

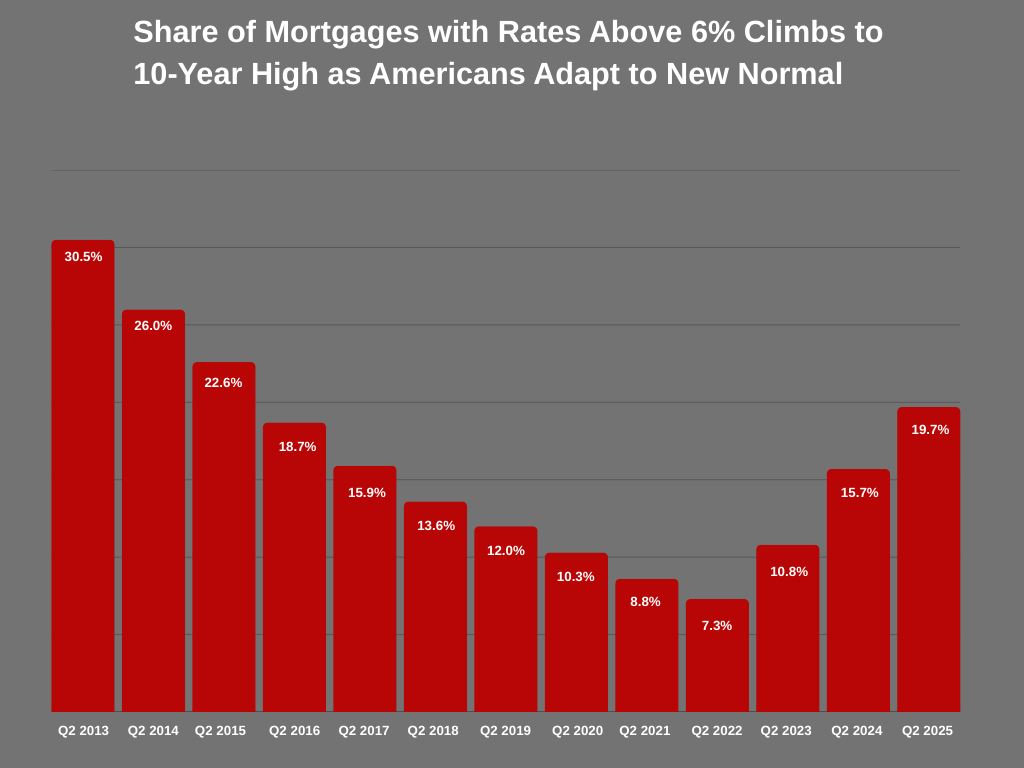

Higher Mortgage Rates Are Becoming the New Normal

Another key trend: mortgage rates above 6% are no longer the exception—they’re increasingly common.

Key takeaway:

As buyers and sellers adapt to the current market, higher rates are becoming part of everyday housing decisions rather than a reason to wait indefinitely.

How Buyers Are Adapting Instead of Waiting

Rather than sitting on the sidelines, many buyers are adjusting their strategies, including:

-

Using equity from a current home

-

Making larger down payments

-

Buying with the intention to refinance later

-

Choosing homes that better fit long-term needs

This shift shows a growing understanding that rates can change—but life keeps moving.

The Bigger Picture: It’s About More Than the Rate

Mortgage rates are important, but they are only one piece of the puzzle. The data makes one thing clear:

Moves today are being driven by life changes, not just headlines.

Waiting for the “perfect” rate can mean delaying necessary or meaningful life decisions. For many homeowners, the right home at the right time matters more than holding onto a historically low rate.

Final Thoughts

If you’ve been wondering whether it makes sense to move in today’s market, the answer isn’t one-size-fits-all. It’s about looking at the full picture—your lifestyle, your equity, your long-term plans, and how today’s market fits into your future.

Understanding the data helps take emotion out of the decision and replaces it with clarity.